6 Expert Tips On How To Beat An IRS Audit

Ezra Cabrera | August 14, 2021

Key Takeaways

- The reasoning behind tax audits is that the IRS needs to minimize the tax gap – or the difference between the amount owed to them and the amount they actually receive.

- A big part of the preparation is collecting and organizing every relevant financial record and documentation including bills, canceled checks, payroll records, ledgers, loan agreements, legal papers, and receipts.

- Several issues will attract the attention of the IRS and likely prompt an investigation including: math errors, failing to report certain income, claiming excessive deductions for charitable donations, filing personal expenses as business expenses, reporting repeated losses on a Schedule C, wrongly claiming a home office as a deductible, and more.

Every year both businesses and individuals must file their taxes, and occasionally the Inland Revenue Service (IRS) needs to double-check the information and figures provided to ensure there are no discrepancies. The IRS also checks if there is a request for answers and additional documentation.

The reasoning behind tax audits is that the IRS needs to minimize the tax gap – or the difference between the amount owed to them and the amount they actually receive. Tax audits can sometimes occur randomly, however many taxpayers are selected for auditing based on perceived suspicious activity.

Several issues will attract the attention of the IRS and likely prompt an investigation including:

- Math errors

- Failing to report certain income

- Claiming excessive deductions for charitable donations

- Filing personal expenses as business expenses

- Reporting repeated losses on a Schedule C

- Wrongly claiming a home office as a deductible

- Completing forms with rounded numbers, for example, $1000 looks like an estimation rather than a true figure which could be $993

- Failing to pay taxes on time

- Underreporting income

- Hiding noteworthy and sizeable transactions

- Undervaluing or overvaluing property

Accurately completing a tax return will decrease the chances of experiencing an audit, however IRS tax audits do occur and some result in the business or individual being found guilty of breaking tax laws. Typically, offending parties are issued with a fine based on the 20% accuracy rule, if the tax owed is $1000, the IRS adds 20% and the plaintiff pays $1200 in total back taxes and penalties.

Dealing with a tax audit from the IRS can be somewhat daunting. However, by reading up on some advice and tips, such as those in this article, people can ensure they are well-prepared to pass the audit and satisfy the inquiries and requirements of the IRS.

Understand The Type Of Audit

When receiving an audit notice, understand which kind of audit the IRS would like to conduct. The tax gurus at Tax Shark point out that there are four types of audits carried out by the IRS; correspondence audit, office audit, field audit, and a Taxpayer Compliance Measurement (TCMP) Audit. After receiving an audit notice from the IRS, be sure to read it carefully to understand the type of audit, the request or question, and the deadline for response.

Correspondence audits involve receiving a 566 Letter requesting certain information or asking specific questions, or a CP2000 notifying that the IRS is planning to make a tax adjustment due to under or overpayment.

Other times people are required to present themselves at an IRS field office to respond to queries, usually regarding issues related to deductions, business profits or losses, and rental incomes or expenses.

Field audits are when the IRS visits a taxpayer’s home or business premises, generally for more serious issues so IRS agents may request to review many aspects of a business or taxpayer’s life.

A Taxpayer Compliance Measurement Program (TCMP) Audit occurs randomly as part of a larger audit to provide the IRS information on how it is performing. These can be in-depth audits with an analysis of every part of a tax return.

Follow The Notice Carefully

Businesses and individuals can typically pass an IRS audit easily if they work with the IRS and respond to queries. It is worth remembering that audits are based on answering three basic questions:

- Is the business real?

- Are deductions correct and legitimate?

- Has all income been reported?

Reading the notice carefully and answering the questions above improves your chances of passing an audit.

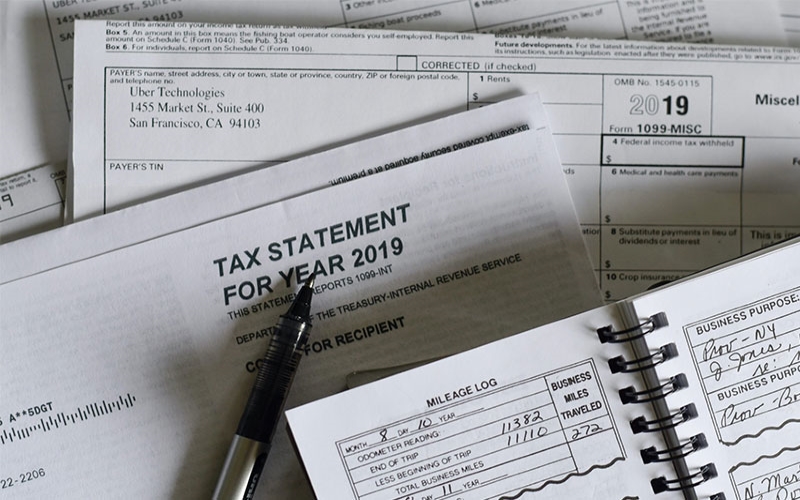

Organize Financial Records

Being prepared for an IRS audit will make it easier to deal with when it does happen, and of course, a big part of the preparation is collecting and organizing every relevant financial record and documentation including bills, canceled checks, payroll records, ledgers, loan agreements, legal papers, and receipts.

Find or Replace Missing Records

Sometimes when the IRS is checking a tax return they may notice missing records and rather than just claiming they are lost or missing it is best to organize duplicates or locate the missing information.

Provide the Right Documents and Be Honest

Be honest and truthful with an IRS agent, especially since some questions they ask will be to verify someone’s trustworthiness. People who are caught lying or submitting falsified documents may end up being charged with criminal tax fraud or evasion.

Substantial Compliance Applies

Usually, if an individual or business can provide enough proof that they have properly filed for taxes, then an IRS agent will allow the omission of smaller records. The IRS refers to this as substantial compliance, meaning if the agent believes all due diligence in a tax return has been followed then compliance can be assumed.

The Bottom Line

Receiving an audit notice and preparing to respond can be stressful. However, it can be made much easier by ensuring you have done your research, taken note of advice, and organized your documents.